The concept of a social credit system is based on a government-run credit rating system that assigns a trustworthiness score to its citizens and businesses, who could then be blacklisted or whitelisted based on the score itself. How close are we to the social credit score in the west? Is it still a fiction or a reality?

Social Credit Score

The concept of a social credit system is based on a government-run credit rating system that assigns score and trustworthiness to its citizens and businesses, which could be blacklisted or whitelisted based on the score itself. China’s social credit system started as a regional trial in 2009 and was expanded into a national pilot with eight credit scoring firms in 2014. The social credit system in China in 2023 is a government-operated system that tracks and evaluates the behavior of individuals and businesses. China’s social credit system is a combination of government sponsored surveillance of individuals, businesses, and government agencies through their social interactions. For example, certain behaviors can negatively impact citizens and their ability to function in the society. Citizens could be “punished” by losing certain privileges because of unfavorable behaviors. A negative social credit score may affect travel, employment, access to finances and many other social interactions.

Are Social Credit Systems Already Here?

Let’s look at some recent examples from around the world of blacklisting. Our neighbors to the north, involved with the Freedom Convoy had their bank accounts seized. The Canadian authorities had frozen 210 bank accounts with total holdings of 7.8 million Canadian dollars linked to the protesters in Ottawa. More recently, Nigel Farage, former leader of the Brexit Party in UK, had several bank accounts closed because of his “controversial” views, according to the banks in question.

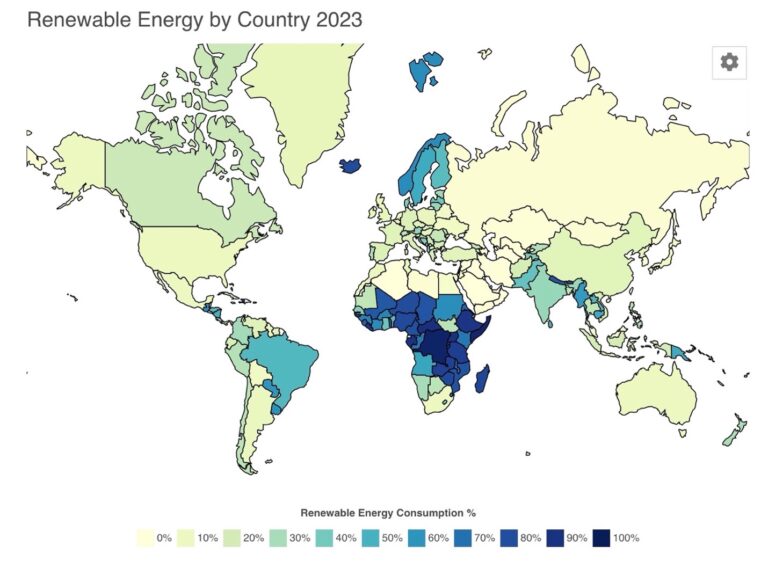

The concept of ESG scores and the “sustainability” concept was introduced by the United Nations in 2006 with the publication “Principles for Responsible Investing,” which advocated investments that included environmental, social and governance (ESG) concepts. ESG is a framework used to access business practices and performance on various sustainability and ethical issues, including carbon impact, air and water pollution, deforestation, natural resource depletion, biodiversity, energy consumption and efficiency, etc. According to many critics, ESG is a social credit scoring system that is changing how businesses are measured by banking systems, investors, and government institutions.

The idea that a social credit system would ever be implemented in the free world used to be far-fetched and laughable, but as we have seen with some of the examples listed above, certain aspects of our lives are already affected by it. What better way to control the behavior of a nation than a punishment and a reward system, blacklisting and whitelisting its citizens?

As Herbert Hoover once said:

“Freedom is the open window through which pours the sunlight of the human spirit and human dignity.”

Let’s not take it for granted.

Also published at: https://globalcovidsummit.org/experts/drkatlindley/opinion/social-credit-score-fiction-or-reality